Target // Stationery

During my time as a Manager in Visual Merchandising, at Target, our department went through a restructure to combine roles and create on holistic Experience team, in 2024. In this re-org, Visual Merchandising was combined with Store Experience Marketing, to create what is now known as RBX: the Retail Brand Experience Team. In this combination of roles, each Visual Manager absorbed the additional responsibilities of the In-store Signage team, for their given department, to have one point-person for all experience steps over a division. During this restructure, some team members were moved to different businesses, I was one of those individuals. While I remained working on Hearth + Hand, I was taken off of Kitchen + Kids Domestics and re-routed to lean into 2 areas that Visual Merchandising was not yet leaning into: Stationery and Storage Utility. These areas had SEM (store experience marketing/signage) support previously, but we needed to unlock how we could stand-up the Visual capability in these worlds, to better improve the guest experience + evolve our stores further.

Stepping into the Stationery world and trying to solve for how we introduce the Visual Merchandising Operating Model + working streams into this area, has been complex but also exhilarating! It is extremely rewarding to be trusted as the point person to lean in and lead the work of how we improve efficiencies, as well as being trusted to advocate for what our best way-in and overall approach to standing up a new capability in an existing business can look like. We are not yet where we want to be for this evolution of the Stationery division, but there has been a lot of great work done to get us on the right path. From learning new CFTs, becoming a valuable voice at the roundtable, gaining trust with new + hesitant partners, and disrupting the current work-streams to encourage new ways of working, to challenging the status quo, pushing the boundaries of what is possible, and advocating for developing first-to-market concepts that keep Target in the on-trend leader seat, the work has been fast + furious! Below you will see 2 examples of work-streams actively being developed: Winning Party (2027 and beyond) + Standing up a Helium Balloon capability (immediately/ 2025).

Winning PARTY…

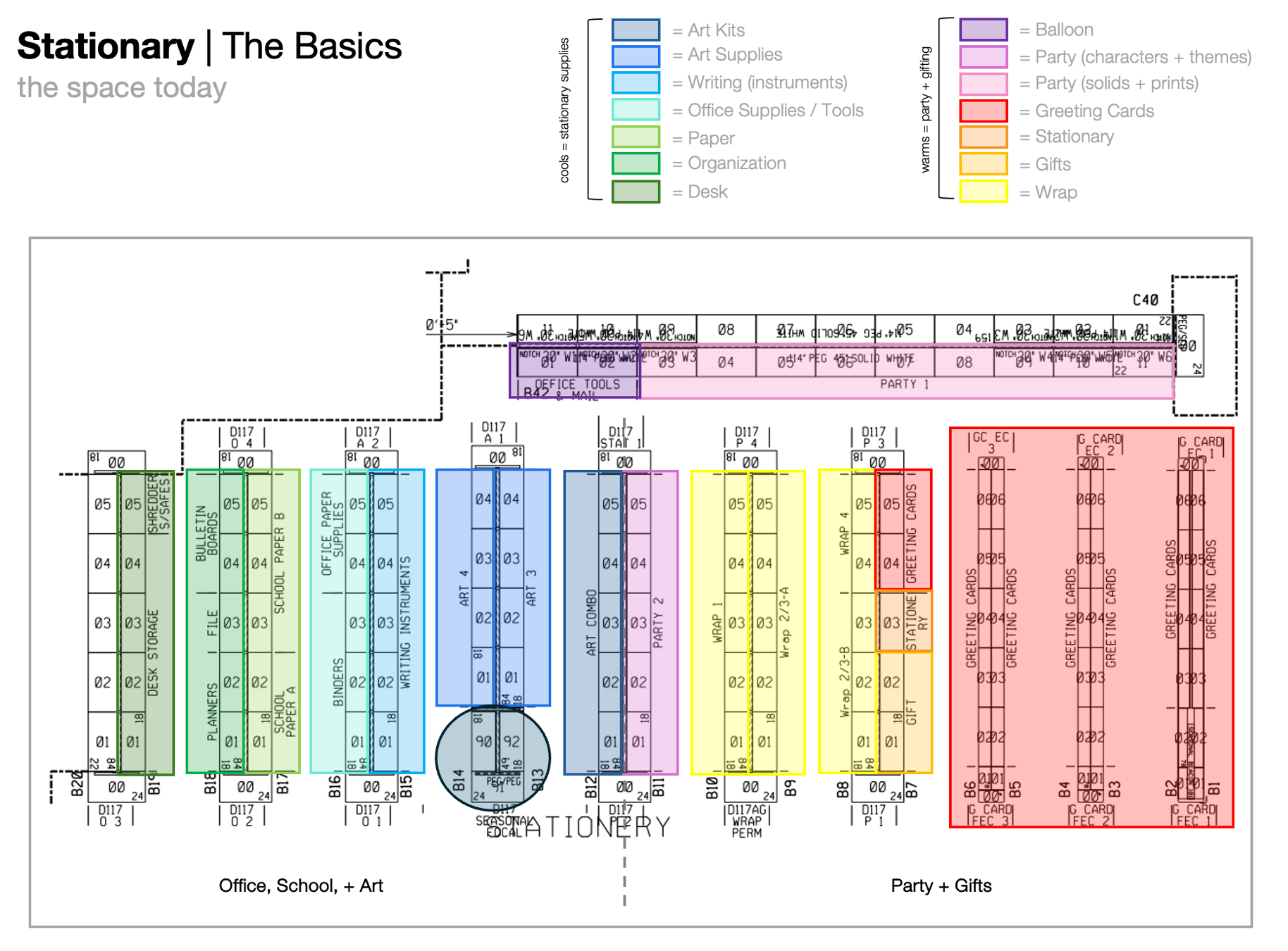

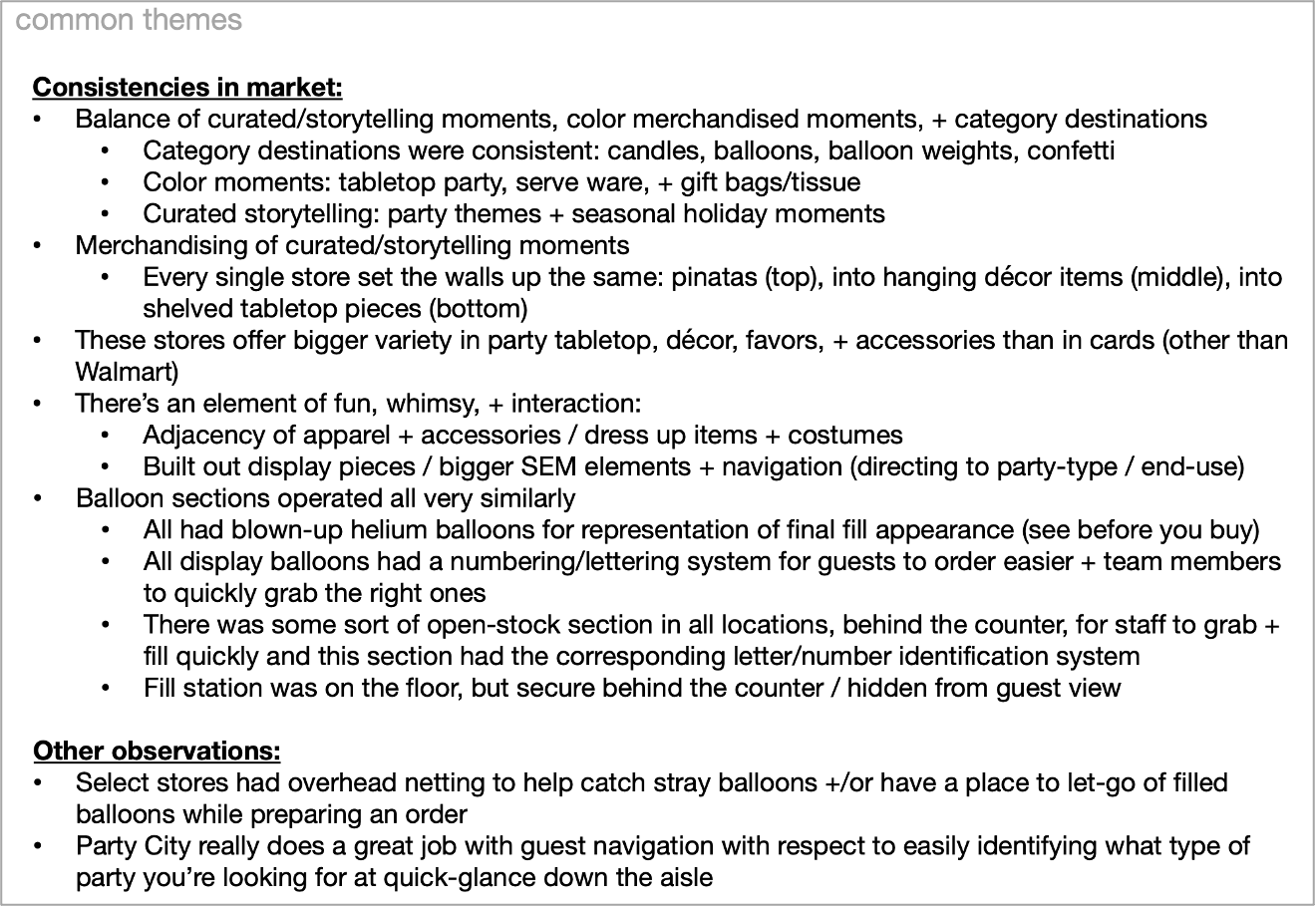

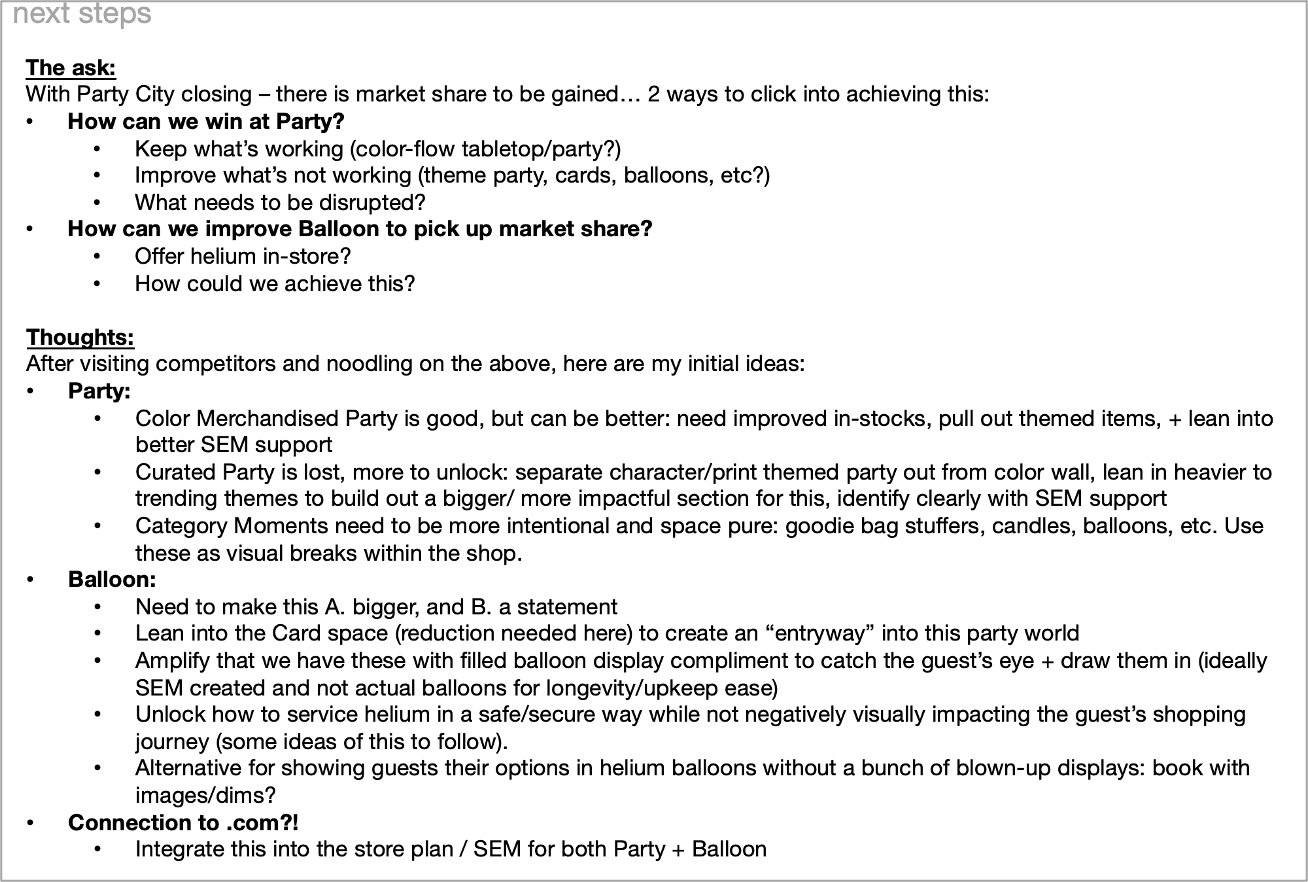

When I first joined the Stationery team, there was no scope of what this work would look like or what it should entail. That open-ended exploration was awesome. It allowed me to really dive into learning what is currently in the market, how are we showing up, is it competitive, where are we lacking, + then allowing for a dream-state (so-to-speak) of possibility. First day on the business, and there was no time to waste. RBX hadn’t been given any direction from the Merch team yet of wants + needs for evolving their space to work harder for them (that information would come at a later date!) but RBX leadership was hungry to have us show up in a way that was impactful + proposed some new ideas to get the team comfortable with being uncomfortable. Because of this, I was tasked immediately to just run: learn as much as I could about the businesses: Stationery as a whole, as well as Party specifically, understand what big Party retailers are doing (what’s working + what’s not), understand what our direct competitors are doing (similar or different than us), then DREAM. The goal was to take all learnings, the good + the bad, and understand what we should + shouldn’t do to Win Party… but also take these learnings + dive into a dream state of concepting that could translate what Winning Party would mean to Target specifically. How we could improve the guest shopping journey + be leaders in the industry within the Party space. The added nuance to this work was the fact that Party City had just announced they were closing their doors, and there would soon be a LOT of market share on the table to be scooped up— ideally by Target. Unfortunately, with Target’s workstreams + overall timelines, as well as set transition limitations— this work would not come to fruition immediately and would need to be a phased approach. Below you will see some of this Winning Party work. The current state of the Stationery adjacency, and some potential shifts + proposals mapped out based on learnings. I had pulled together about a 50 page deck of competitive swipe images + learnings, but below you will only see a snapshot of that. From those educational trips + learning insights, I then proposed some mapped shifts to the adjacency, as well as rendered out potential adjustments to the way we look at the space today. Some of this is also inclusive of the idea of introducing Helium Balloons into stores as well, which is the 2nd project you’ll learn more about in the following section. The images shown below are the very up-front work of data gathering + first-pass ideating. The Stationery business will not be able to effect a major space change due to workload hours + process limitations until 2027, so unfortunately I may not see this project all the way through to fruition. But, I am proud of the upfront work in kicking off such a massive potential shift in the way Target’s Stationery world operates!

research, analyze, + ideate:

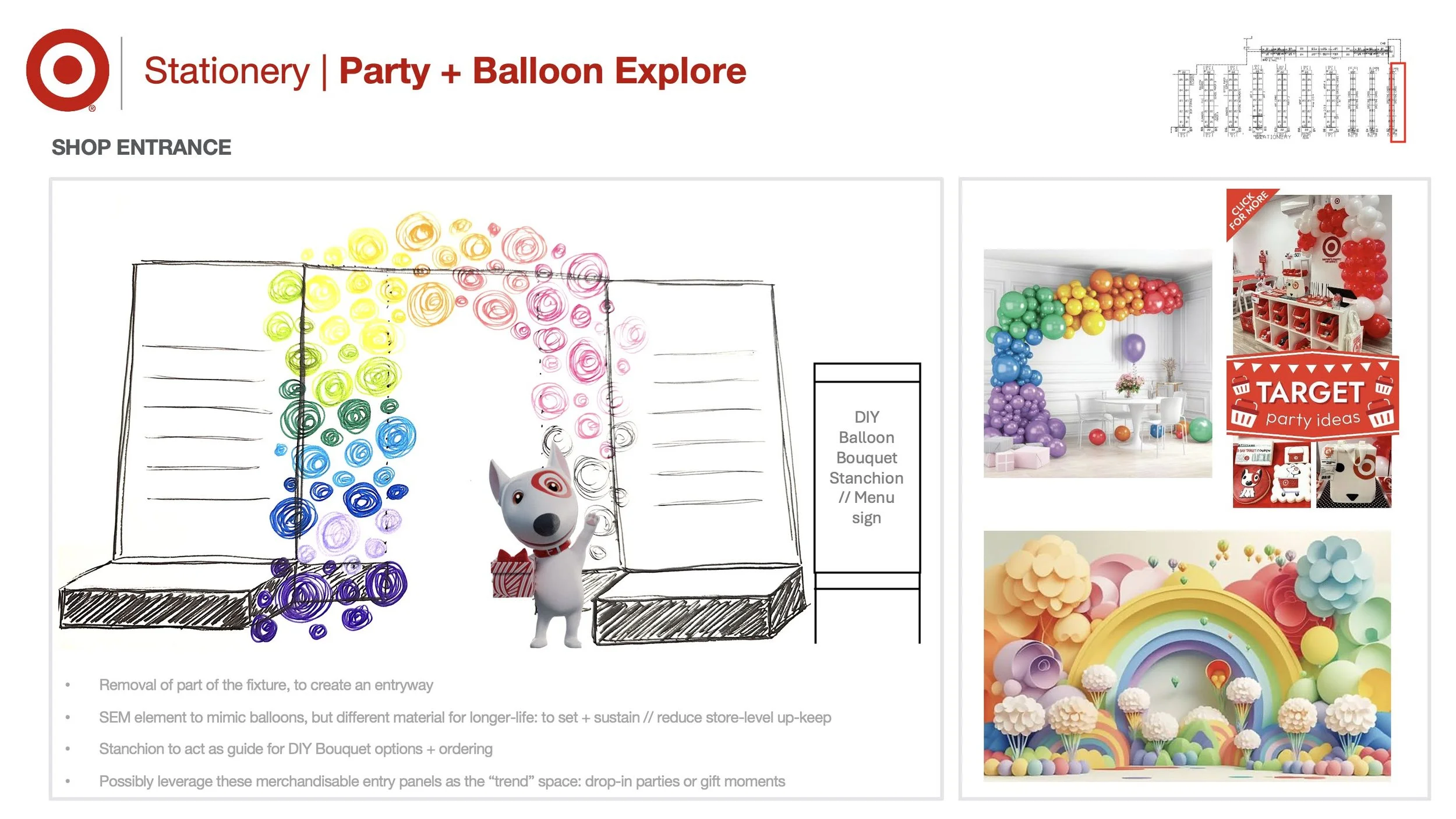

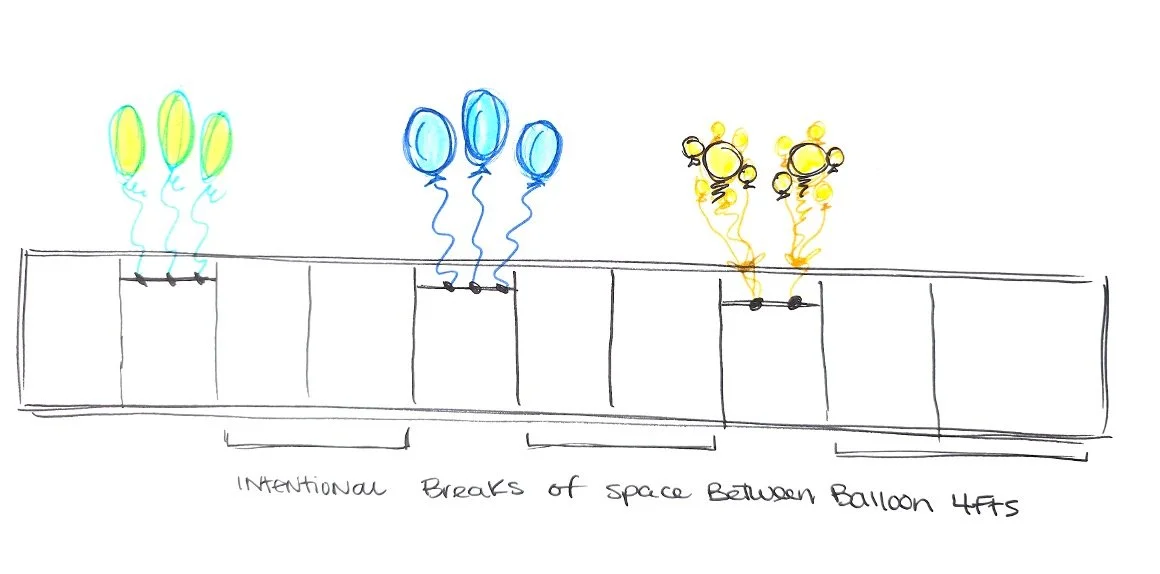

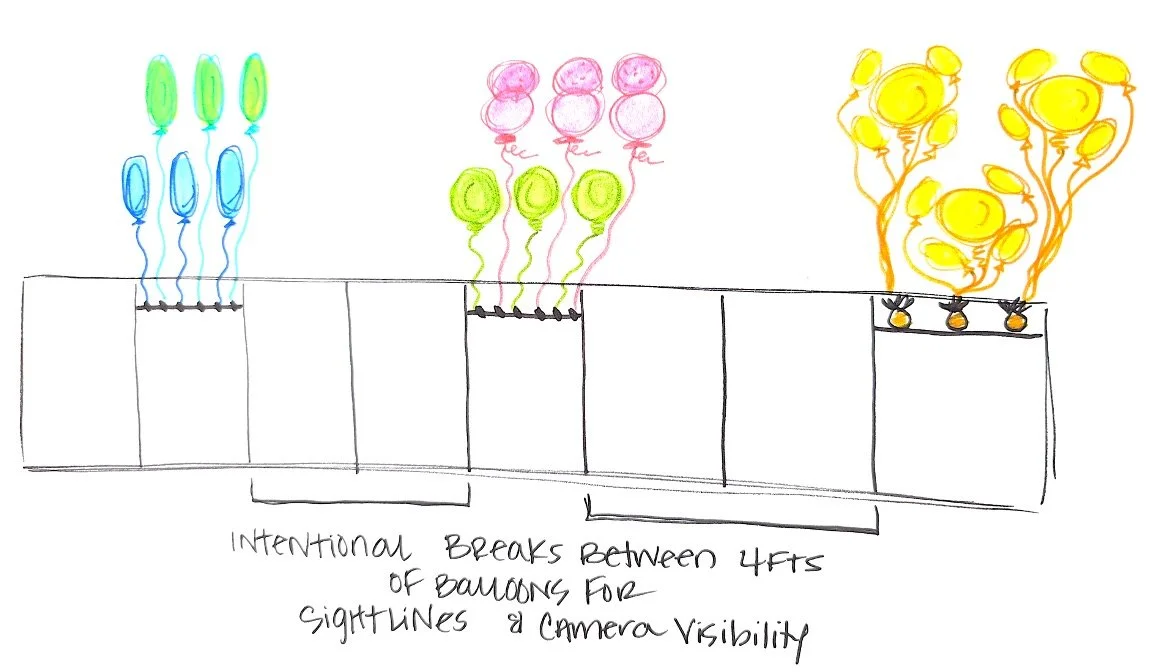

conceptualize:

illustrations (created by my associate) based on my brief:

Standing Up HELIUM…

As mentioned above, part of Winning Party is also introducing Helium Balloons into Target stores. Another step in the direction of scooping up that Party City market share + remaining competitive in the market. Again, with timing and processes, impacting something like this immediately is very difficult for a large-scale retailer like Target. However, this work was prioritized + expedited, and heavily supported by leadership to ignite quickly, due to the massive size of prize on the table for potential sales growth opportunities. Knowing we couldn’t impact our in-line Stationery space until 2027, but we needed a solve for 2025, we had to work differently. A Helium Balloons CFT was started + I was the RBX (VM + SEM) lead to run-point on this project! Over the course of working on this initiative, we came to the conclusion that this would need to be a multi-phased process to get to where we wanted to be.

Phase 1: get Grab + Go Helium Balloons into test stores immediately to learn + react quickly, we had about 2 months to pull this off.

Phase 2: take those test learnings, make any necessary adjustments, and rollout to a portion of the chain.

Phase 3: Understand key Seasonal Bulk-out moments where Grab + Go quantities increase heavily leading up to a key milestone holiday, prepare a different Bulk-out Strategy Execution Guide for stores.

Phase 4: potentially rollout both Everyday Grab + Go Helium and Seasonal Bulk-out Strategy Helium processes to more doors (space constrained + backroom limited).

Phase 5: integrate additional Helium services like Drive-up, Order Pick Up, and possible Delivery.

Phase 6: expand offering to include Build-your-own Bouquets / DIY Bundles (possible addition of Helium Latex Balloons as well).

Phase 7: stationery space move / map-it in 2027, create a Balloon Hub for this service.

Below you will see some of the work I did for Phases 1, 2 + 3 of this initiative. For Phase 1 you will see work related to: conducting capacity studies + translating those into renderings, concepting out + creating the Helium Grab + Go in-store experience and Visual Merchandising Guardrails for the 5 POC Test stores, and briefing + kicking off this project to our creative agency to get in-store signage created. You will also see some in-store set example photos of how this came to life in-stores. For Phase 2 you will see: recapping of learnings + feedback from the test stores and making rollout adjustments + a rollout proposal pitch deck for leaders to align on. For Phase 3 you will see additional capacity and render explores for the Seasonal Bulk-out strategy.

Phase 1: 5 Test Stores

ideation + capacity studies

store guidance document creation

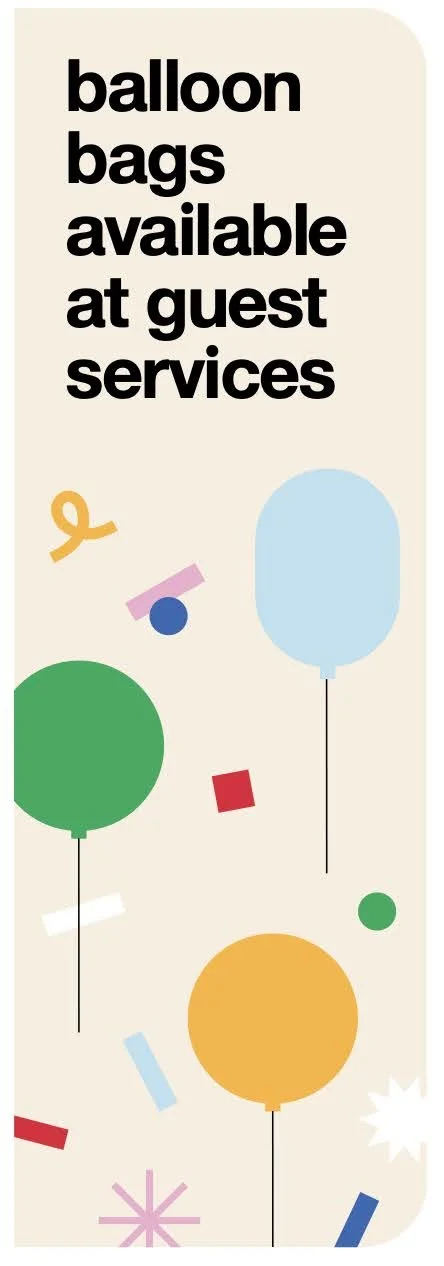

in-store signage creation

store execution images:

Phase 2: Rollout to more doors

test store learnings + hindsighting

rollout proposal

store guidance renderings

in-store signage updates

Phase 3: Seasonal Bulk-out

capacity + set direction explorations

in the works // coming soon!

Cyclical Work…

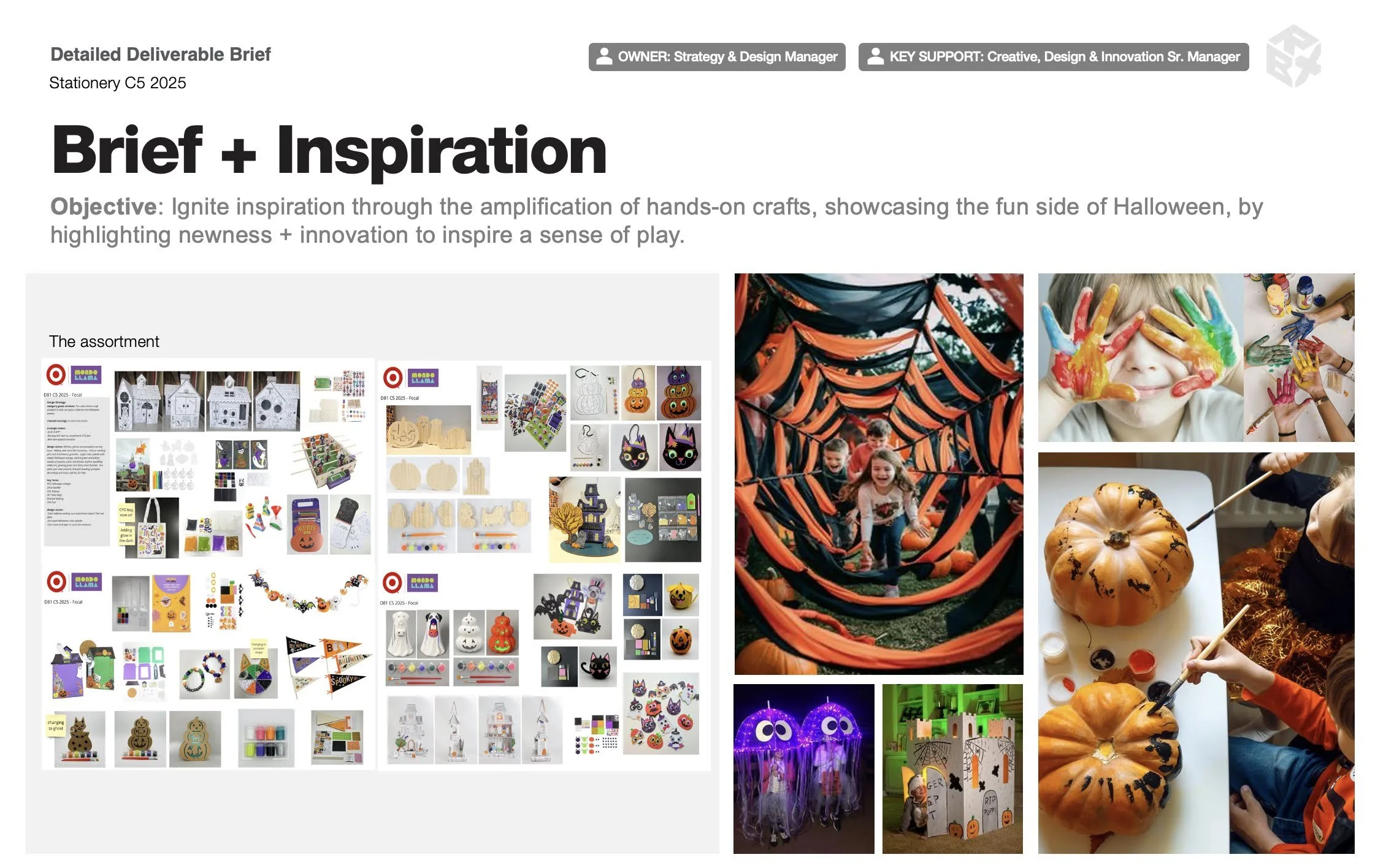

Joining an area that did not have Visual Merchandising support previously, but did receive in-store marketing support, meant leaning in further to the SEM (store experience marketing) side of things more heavily. This included understanding Merch strategies, value projections, and necessary communication for the guest experience, partnering with SPT (space and presentation team) on adjacencies + POG build timing to ensure marketing elements were developed on the right timeline, and owning the development of the creative brief that is leveraged to kickoff marketing work to our agency partners. This also meant deeper partnership with agency teams, multiple rounds of creative reviews and proofing feedback, and alignment moments with the Target Creative team to ensure all developed elements fit the Target style, spoke to the same Target voice, and followed all pre-developed toolkits, while also tying into the overarching Storewide creative as necessary. Below you will see a couple snapshots of the briefing work and the end result marketing that came from those creative kickoffs and multiple rounds of partnership with the creative agency.

In addition to leaning into the Brand Management side of things through in-store marketing, we were also figuring out how RBX would lean into different areas of this business from a Visual Merchandising lens. Every cycle our partnership with the team changed + grew, and responsibilities + outputs evolved. We still haven’t fully refined what that end-state partnership will look like, but a lot of progress has been made. RBX now owns multiple builds each cycle: the Focal fixtures, Beacon table moments in select version builds, and all Endcaps that require either containment to be developed or larger storytelling to be achieved. While this is still a work in progress to evolve the process and get to a place where VM is more strategically baked into the up-front work with the team, there have been some wins so far. Below is an example of one of the more high-profile Endcaps, for a brand partnership, that took multiple rounds of assessing ways-in to improve presentation + fit, reduce containment costs, and overall improve the ROI (return on investment) of the set.

Cyclical briefing + SEM results

C5 2025:

C6 2025:

Visual Merchandising + containment deep-dive

C6 2025:

C1 2026:

in the works // coming soon!